Chapter 5: Economic Development, Enterprise and Retail Development

To develop and build on the economic strengths and assets of the county as a thriving, competitive and attractive place for a range of sectors to locate, based on the principles of a well-established economic base that is highly appealing to both investors and employees.

5.1 Introduction

Galway County Council recognises the pivotal role of the economic, enterprise and retail sectors to the county. It is the primary aim of the plan to build on the economic strengths within the county and address in a sustainable manner, the areas of the county that requires attention in this regard.

Galway forms part of the North-West Region and is regarded as the region’s primary economic engine in terms of job creation and economic prosperity. This chapter will identify policy objectives to support key economic sectors and employment generators in the county. There are a range of new economic issues facing the County which were not apparent in previous County Development Plans and these have been the subject of uncertainty in recent years. These include: the impact of Brexit; the Covid 19 pandemic, carbon emission targets and the pronounced shift towards remote working in hubs and the provision of home working. A suite of robust policy objectives is included which promote economic development within the county.

This chapter will also cover the related area of retail development. In particular, it will focus on the provisions set out in the RSES regarding the provision of retail development and the application of the Retail Planning Guidelines, 2012. In line with the settlement hierarchy of the County a retail analysis has been included which guides retail development to appropriate locations across the County.

It is considered that this chapter is consistent with and reinforces other aspects of the Plan including the Settlement Hierarchy, urban design and placemaking policies and the plan’s transport and climate adaptation strategy. This will deliver quality development outcomes including sustainable mixed use development models encompassing residential and employment activity. Timely delivery of critical infrastructure, which includes effective and reliable access to public transport, is also critical to the delivery of sustainable forms of development.

5.2 Strategic Aims

Galway County Council shall work with the appropriate agencies and stakeholders in order to safeguard the delivery of sustainable economic growth in accordance with the following strategic aims:

- To promote growth and employment across the county in accordance with the core strategy and Galway County Transport and Planning Study enabling people to work in the county and enjoy a good standard of living;

- To support the delivery of a range of employment uses including retail on brownfield and infill sites in towns and villages across the County;

- To ensure the attractiveness of Galway is retained and developed further as a location for domestic and foreign direct investment;

- To continue the delivery of high quality living environments across Galway so as to retain and build on the County’s reputation as an attractive business environment for foreign direct investment;

- To support where appropriate the establishment of remote working hubs in towns and villages across the county with access to high speed broadband which will enable people to ‘log-on’ anywhere regardless of where they work;

- To support individuals in being able to work from home.

5.3 Strategic Context

This chapter is prepared in the context of the following, national, regional plans, policies and guidelines:

|

National Planning Framework 2018 |

|

National Development Plan 2018 – 2027 |

|

Regional Spatial and Economic Strategy (RSES) for the Northern and Western Region 2020 |

|

Food Wise 2025: A 10 Year Vision for the Irish Agri-Food Industry 2015 |

|

Galway County Council Local Economic and Community Plan 2017 |

|

Enterprise 2025 Renewal 2018 |

|

Retail Planning Guidelines 2012 |

|

Realising our Rural Potential 2017 |

|

National Policy Statement on the Bioeconomy 2018 |

|

National Mitigation Plan 2017 |

|

Galway Transport and Planning Strategy |

|

Galway Transportation Strategy 2016 |

|

Making Remote Work: National Remote Work Strategy 2021 |

5.3.1 National Planning Framework

The National Planning Framework (NPF) recognises the economic contribution of Galway within the North West Region. A number of NPO’s reference the interconnection of employment with land use planning. NPO 7 encourages population growth in strong employment and service centres, regeneration of smaller urban centres, addressing legacy of unplanned growth and facilitating ‘catch-up’, balance population and employment growth.

NPO 11 states a presumption in favour of development that can encourage more people and generate more jobs and activity within existing towns and villages. Brownfield and infill development will be encouraged in the towns and villages across the county in order to strengthen the county’s urban structure as identified in the NPF as set out by this policy objective.

5.3.2 Regional Spatial and Economic Strategy

The focus of the Regional Spatial and Economic Strategy (RSES) is on place-based assets as well as sectors and clusters. The RSES approach aims to realise the full potential of the region through investments in placemaking, developing places that are attractive for business investment and for people to live and work.

At a macro level there are a number of RPO’s that encourage settlements to; harness their export capacity by promoting trade and global opportunities; by being vibrant and distinctive, where our communities act as a spur for quality of life, creativity and innovation and are attractive for innovators, investors, business, visitors and all residents.

5.3.3 Galway County Local Economic and Community Plan 2016-2022

The Galway County Local Economic and Community Plan (LECP) sets out the vision for County Galway:

An inclusive County with a clear sense of identity where we work together towards achieving the full economic, social, community, linguistic and cultural potential of County Galway and of its people through citizen engagement at a local level.

Policy objectives identified in this economic chapter support Theme 1: Employment and Enterprise of the LECP and the high-level goal of enhancing the quantity and quality of employment and enterprise opportunities throughout the County. Objective 3 which is supportive of infrastructural investment seeks a collaborative approach with the IDA Ireland to promote Galway as a location for Bio-Pharma development and investment, leveraging off the existing Life Sciences cluster including the Monksland area of County Roscommon and the existing utility-intensive Strategic Sites in Oranmore and Athenry.

5.4 Climate Change

Along with infrastructure such as high-quality public transport, broadband and access to childcare facilities, economic development and delivery of jobs must be provided in full consideration of the climate action agenda. The Climate Action Plan (CAP) for Ireland highlights the importance of the enterprise sector in ensuring that we meet our climate change targets for the years ahead. In effect, the ambition is to transition to a low carbon climate resilient society as set out in NPO 54 and 21 in the NPF.

The manufacturing sector is identified in the CAP as the industry that creates the highest level of emissions in Ireland, which are typically caused by chemicals, food processing, beverages and cement.

The level of carbon emissions related to economic activity peaks during times of economic prosperity, due to the intensification of activity and reduces during times of recession, which can be attributed to a dilution in economic activity.

In identifying areas for employment, enterprise and retail related development a concerted emphasis will be placed on facilitating and encouraging carbon reduction through various mechanisms. The focus on delivering jobs in close proximity to residential areas to enable people to use sustainable transport modes to access work (walking, cycling and public transport) is at a most basic level something that is supported to help address the Climate Change agenda.

The shift to a low carbon economy across Galway is seen as an opportunity for further employment creation within this sector through technological innovation and investment.

5.5 Economic Profile of County Galway

The population in the county is growing with 179,390 persons recorded in the 2016 census, 2.4% higher than at the previous census (2011). Total employment also increased with 8.5% growth over the same period. Some 61.3% of Galway County’s adults are in the labour force, either working or looking for work, close to the national average (61.9%). The 85,054 people who are in the county’s labour force represents a 0.6% increase on the 2011 figure, compared with 3.2% growth nationally. The share of Galway County’s adults who are ‘at work’ (54.1%) is above the national average, while the share unemployed is somewhat lower.

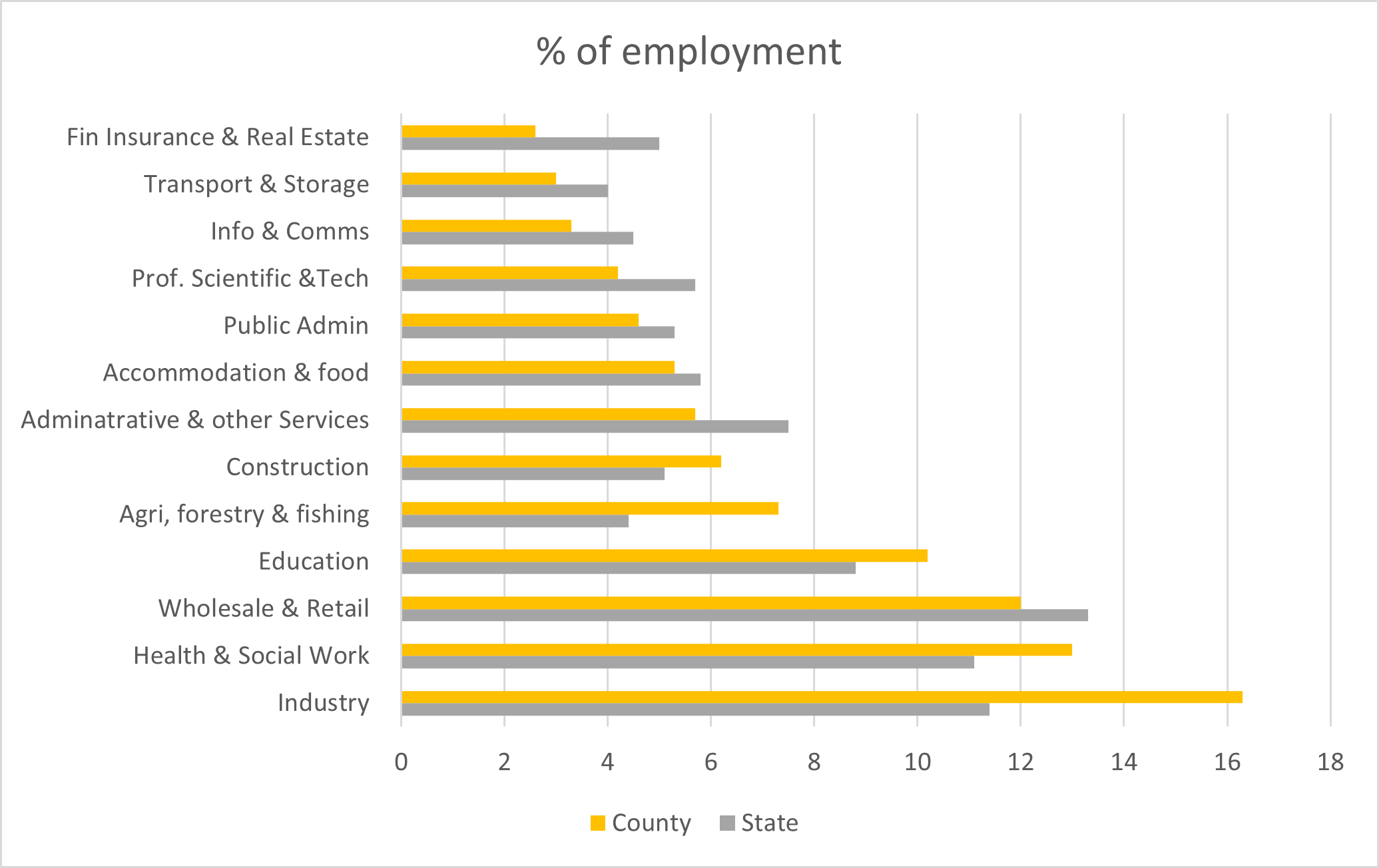

The broad sectors where the 75,116 Galway County residents who are ‘at work’ are employed are identified in Figure 5.1 below. The main sectors of employment include construction, retail and wholesale, professional, scientific & technical, along with industry and health and care. More recently the agri-food and agri-engineering sectors have gained momentum locally and the tourism industry has always been a sustained source of employment.

Sectors that employ a higher percentage of the workers when compared to the state overall include industry, health and social work, education, agriculture forestry and fishing and construction.

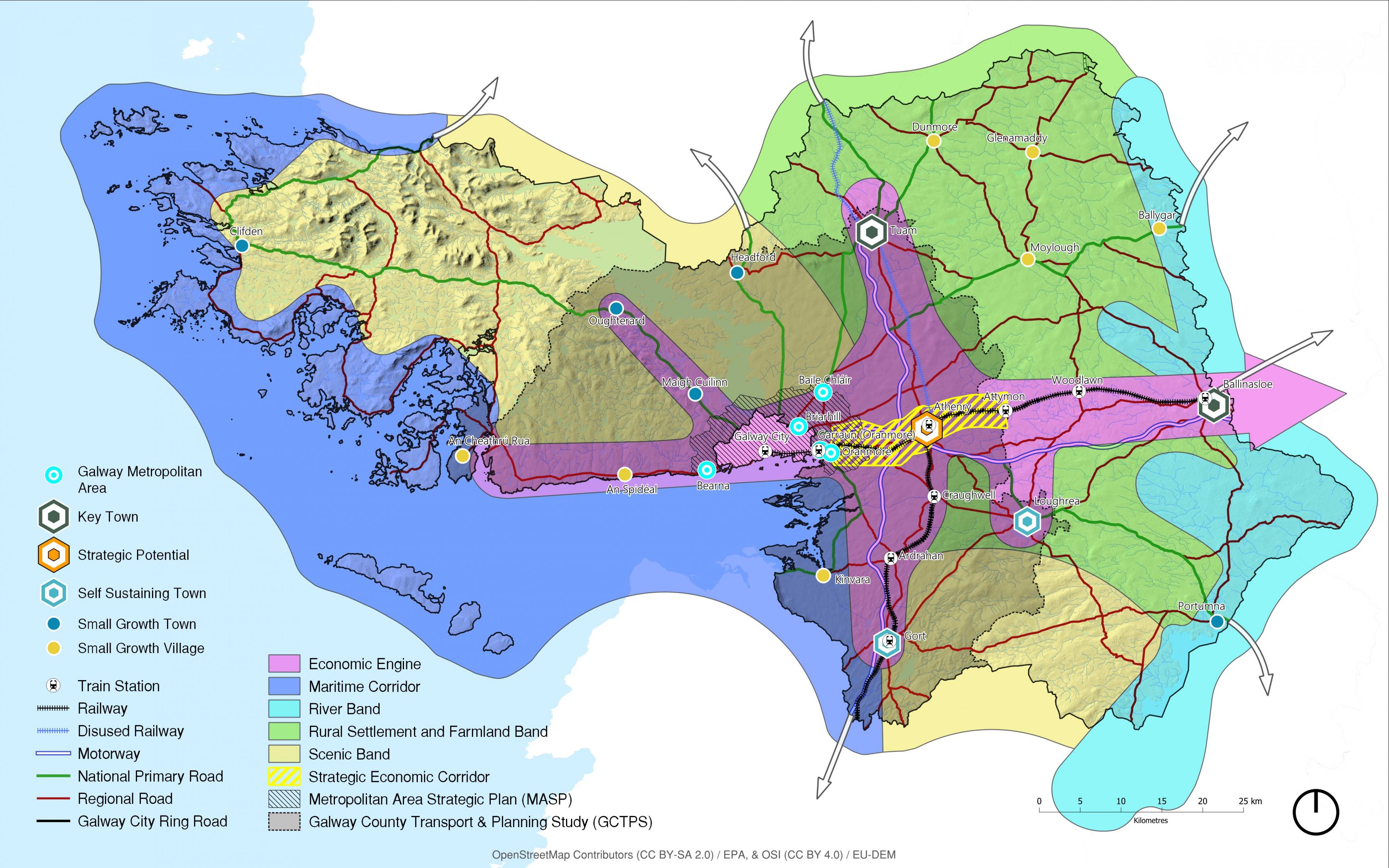

Figure 5.1 Percentage of total employment in each broad sector in Galway County and State, 2016

Wholesale & Retail is less important in Galway County than elsewhere. Employment in Wholesale & Retail declined 0.4% since 2011; compared with a slight increase nationally (1.7%). Financial services in contrast saw employment decline by 7.7% compared with a 1.3% decline nationally. This is linked to closures of local bank and insurance branches. Meanwhile accommodation & Food Service enjoyed strong employment growth, up 13.3%, slightly above the 12.9% national growth, indicating strengthening tourism activity.

Knowledge intensive services (Professional, Scientific & Technical activities, Financial, Insurance & Real Estate and Information & Communications) are among the county’s smallest employers. However Information & Communications had the county’s second strongest employment growth (18.7%), while Professional services also increased (8.3%); though both below State average growth of 31.4% and 22.2% respectively.

5.5.1 Jobs Forecast - County Jobs Ratio

Jobs growth across the county will be delivered in tandem with population growth during the lifetime of this Plan. To maintain current levels of employment, it is estimated that the labour force of Galway could increase to as much as 103,606 persons by 2031 (54.1% Population 15+ yrs) and that almost 16,321 new jobs will be required up to 2031 to achieve a jobs ratio of 0.70 (see Tables 5.1-5.3 below). These figures provide a broad parameter for the assessment of the supply of zoned employment land in the county and will also be used on a settlement by settlement basis within LAPs to identify towns where additional policy measures are required.

The jobs ratio is an indicator of the balance that exists between the location of the labour force and the location of jobs and is often used as an indicator to measure the sustainability of settlements. The National Planning Framework provides data in relation to population and employment in urban settlements based on the Census of Population 2016 and provides job ratio information in relation to the main urban settlements in the county.

As this Plan seeks to foster employment creation and maximise the jobs potential in growth towns throughout the county and achieve greater alignment between population and employment opportunities it is a high level policy objective to work toward a jobs ratio of 0.70 and above for our main urban areas. In these areas it will be important to ensure that there is an adequate supply of zoned land for employment purposes at appropriate locations to accommodate employment growth and cater for the number jobs that would help achieve this balance.

|

|

2016 |

NPF / RSES Population Target 2026 |

NPF / RSES Population Target 2031 |

Increase |

|---|---|---|---|---|

|

Population |

179,390 |

205,500 (+25,500) |

219,500 (+39,500) |

39,500 |

|

Population 15+ yrs |

138,747 (77% of total population) |

158,235 (77% of total population) |

169,015 (77% of total population) |

|

|

In Labour Force |

85,054 (61.3% of Population 15+ yrs) |

93,478 (est. based on 61.3% of Population 15+ yrs) |

103,606 (est. based on 61.3% of Population 15+ yrs) |

|

|

Persons at Work (no of jobs) |

75,116 (54.1% Population 15+ yrs) |

82,499 (54.1% Population 15+ yrs) |

91,437 (54.1% Population 15+ yrs) |

16,321 |

|

Jobs Ratio |

0.70 |

Target 0.70 |

Target 0.70 |

|

|

Target Resident Workers |

52,581.2 |

57,749 |

64,005 |

11,423.8 |

|

Total Area of Employment Land Required – based on Low-medium density type employment[1] |

2,103,240 210.32 hectares |

2,309,960 m2 230.99 hectares (based on average 30sqm per employee). |

2,560,200 m2 256.02 hectares |

- |

Table 5.1 Jobs Forecast for 2026/ 2031

5.5.2 Economic Profile and Jobs Ratio of Settlements

Table 5.2 overleaf provides data on the jobs ratio for urban settlements in the County. Both Ballinasloe and Tuam demonstrate their strong position to support sustainable growth with high jobs ratios. However, the figures also highlight the settlements where the jobs ratio is low. Maigh Cuilinn, Oranmore and Bearna have a jobs ratio of 0.53, 0.438 and 0.452 respectively which indicates high levels of outbound commuting.

The role and function of Maigh Cuilinn and Bearna and their close proximity to Galway City clearly influences this trend. In these areas, it may not be viable to align jobs with resident workers as they will continue to function predominantly residential settlements supporting the economic function of Galway City and their character as urban villages will be protected. The focus in these areas will be on strengthening the availability of sustainable transport options and where appropriate on providing additional support for working from home.

Oranmore and Athenry also have low jobs ratios of 0.438 and 0.767 respectively. In contrast to policies for Maigh Cuillinn and Bearna, policy objectives for both towns to grow their employment base as part of the Oranmore-Athenry Strategic Economic Corridor is provided through its designation as a location with strategic development potential of a regional scale. Policy objectives to support investment in employment at Oranmore, and Athenry are provided below.

|

Settlement Hierarchy |

Settlement |

Population 2016 |

Resident Workers |

Local Jobs |

% of Galway County Jobs |

Jobs: Resident Workers – Current / Target |

|---|---|---|---|---|---|---|

|

Metropolitan Towns |

Baile Chláir |

1,248 |

621 |

344 |

0.8% |

0.55 |

|

|

Bearna |

859 |

859 |

388 |

0.9% |

0.45 |

|

|

Oranmore |

4990 |

2,591 |

1,134 |

2.6% |

0.44 |

|

Key Towns |

Tuam |

8,767 |

3,270 |

3,700 |

8.6% |

1.13 |

|

|

Ballinasloe |

6,662 |

2,205 |

3,045 |

7.1% |

1.38 |

|

Strategic Potential |

Athenry |

4,445 |

1,891 |

1,450 |

3.4% |

0.77 |

|

Self Sustaining Towns |

Gort |

3,037 |

1,212 |

1,127 |

2.6% |

0.93 |

| Loughrea | 5,556 | 2,295 | 2,225 | 2.96% | 0.969 | |

|

Small Growth Towns |

Clifden |

1,597 |

594 |

856 |

2% |

1.44 |

|

|

Maigh Cuilinn |

1,704 |

751 |

398 |

0.9% |

0.53 |

|

|

Oughterard |

1,318 |

520 |

386 |

0.9% |

0.74 |

|

|

Portumna |

1,450 |

529 |

549 |

1.3% |

1.04 |

|

|

Headford |

973 |

414 |

425 |

1% |

1.03 |

Table 5.2 Jobs ratio for urban settlements

A jobs forecast (CSO 2016) for Oranmore and Athenry which form part of the Strategic Economic Corridor is provided in Table 3 below. It again confirms that the quantity of zoned land is sufficient to cater for future development requirements.

|

Settlement Hierarchy |

Settlement |

Population 2016 |

Population 2028-2028 |

Resident Workers |

Resident Workers |

Local Jobs |

% of Galway County Jobs |

Jobs: Resident Workers – Current / Target |

|---|---|---|---|---|---|---|---|---|

|

Metropolitan Towns |

Oranmore

|

4,990 |

6,690 (4,990 +1,700) |

2,591 |

3,478 |

1,134 |

2.6% |

0.44

|

| 2,434 | 0.70 | |||||||

|

Target 2,434 jobs by 2031 |

||||||||

|

Strategic Potential |

Athenry |

4,445 |

5,945 |

1,891 (42% pop) |

2,497 |

1,450 |

3.4% |

0.77 |

|

|

|

5,945 |

2,497 |

Target 1,747 job by 2031 Total requirement approx.. 70,000 m2 / 70 ha |

||||

Table 5.3 Jobs Forecast for Oranmore-Athenry Strategic Economic Corridor

5.5.3 Economic Benefits and Potential within County Galway

Table 5.4 below illustrates the economic appraisal of the county, highlighting individual settlements and their economic role.

|

Settlement Hierarchy |

Settlement |

Economic Role |

Approach in the CDP |

|---|---|---|---|

|

Metropolitan Towns |

Baile Chláir Bearna Oranmore Garraun*Framework Briarhill*Framework Former Airport Site |

Deliver where possible, sustainable jobs and housing in this area of development pressure.

|

Identify investment required to align employment and residential development.

|

|

Key Towns |

Tuam Ballinasloe

|

Regionally strategic employment centres of significant scale that can act as regional drivers that complement and support the higher-order urban areas within the settlement hierarchy (ie. Regional Growth Centres and Galway Metropolitan Area). They also have the potential to accommodate a significant level of growth in population and employment through appropriate investment in infrastructure, support services and placemaking initiatives. |

Facilitated projected jobs growth through adequate quantity and quality of employment zoned land |

|

Strategic Potential |

Athenry |

A place of strategic potential with the opportunity to provide appropriately zoned land with adequate infrastructural services to accommodate enterprise e.g. Economic Corridor from Oranmore to Athenry. Economic corridors particularly employment corridors such as the Oranmore – Athenry Strategic corridor must be developed/promoted and serviced to high international standards to attract further Foreign Direct Investment and indigenous industries/ businesses, building on the existing strategic location and infrastructure. This corridor will be promoted sustainably as a centre for major national and international enterprises in a manner that shall be further defined in local planning policies. |

Meet demand for projected jobs growth through adequate quantity and quality of employment land. |

|

Self Sustaining Towns |

Gort Loughrea |

Moderate level of jobs and services |

Adequate quantity and quality of employment land |

|

Small Growth Towns

|

Clifden Maigh Cuilinn Oughterard Portumna Headford |

High levels of population growth and a weak employment base. / Local service and employment functions in close proximity to higher order urban areas. |

Improve employment prospects and sustainable transport options |

Table 5.4 Economic appraisal of the county

5.5.4 County Galway Metropolitan Area Strategic Plan

The primary centre identified for growth in the region is Galway City through its designation as a Metropolitan Area in the NPF and RSES. The Galway Metropolitan Area Boundary encompasses both City and County Council areas (Baile Chláir, Bearna and Oranmore) and the MASP sets out the strategic direction the city will grow to achieve compact growth. Both Oranmore and the former Airport Site are identified as key industry and technology sites within the MASP.

The RSES acknowledges that Oranmore forms a significant proportion of the land supply and can accommodate future large scale employment. These lands benefit from being easily accessible due to the improvement of the wider road network in the form of the M6 and M17/M18 motorways. RPO 3.6.5 supports the delivery of lands for employment uses at Parkmore, the former Airport site and Oranmore.

The former Galway Airport Site is also identified as a key opportunity site with significant development potential in the RSES. It is also identified in the NPF as a growth enabler and as such a high level study was carried out by the Council which is appended to this chapter.

The RSES emphasises the delivery of the following infrastructure projects as essential for the development of the metropolitan area. The Council will support their delivery and will prepare and collaborate on the preparation of Implementation Plans as outlined in the RSES. The following infrastructure improvement are prioritised as part of this economic strategy.

- Greater Galway Area Drainage Study

- Galway Drainage Area Plan

5.5.5 Key Towns of Ballinasloe and Tuam

The Key Towns of Ballinasloe and Tuam will act as regionally strategic employment centres of significant scale that can act as regional drivers that complement and support the higher-order urban areas within the settlement hierarchy (i.e. Regional Growth Centres and Galway Metropolitan Area). They also have the potential to accommodate a significant level of growth in population and employment through appropriate investment in infrastructure, support services and placemaking initiatives. Local area plans which will incorporate Local Transport Plans (LTP) will support key priorities for Ballinasloe and Tuam identified in the RSES.

5.5.6 Place of strategic potential – Athenry

Athenry is identified as a place of strategic potential with the opportunity to provide appropriately zoned land with adequate infrastructural services to accommodate employment and enterprise. It is considered that economic corridors particularly employment corridors such as the Oranmore – Athenry Strategic Economic Corridor must be developed/promoted and serviced to high international standards to attract further Foreign Direct Investment and indigenous industries/ businesses, building on its strategic location and existing infrastructure. This corridor should be promoted sustainably as a centre for major national and international enterprises in a manner.

5.5.7 Zoned Employment Land

A high level assessment of zoned employment lands within the County shows that there is 532.57ha of land zoned for employment uses. Approximately 134.71 ha of these lands have been developed and c. 394.07 ha remains available to support economic development and future jobs growth in the county. As illustrated in Table 1 above indicated that by 2031, approximately 256.02 hectares will be required. As c. 394.07 ha of land remains available to support economic development and future jobs growth, it is considered that there is an adequate supply of land zoned for employment but the location of these zonings will be kept under review.

5.6 Economic Strategy

The approach in this Plan is on significant economic growth within the metropolitan towns, key towns and areas of strategic potential. This is consistent with RPO 3.1 of the RSES which supports the development of urban places of regional scale through:

- Delivering on the population targets for the metropolitan and regional growth centres through compact growth

- Delivering significant compact growth in key towns; and

- Developing derelict and underutilised sites, with an initial focus within town cores.

The preparation of an Economic Development Strategy for the county will commence on completion of the next census.

|

Policy Objective Economic Strategy |

|---|

|

ES1 Economic Strategy Support the preparation of an Economic Development Strategy for County Galway. |

5.7 Spatial Employment Designations in County Galway

Along with the network of towns and villages across the county as outlined above Section 5.5 further areas identified for potential employment and enterprise uses are discussed below.

5.7.1 Strategic Economic Corridor

Galway is identified in the RSES as a City and county that will grow in a globally competitive manner that will be compact, connected and inclusive as a place for people and for businesses to grow. The objective for Galway is to create the right conditions for people to live and work. The delivery of jobs to Galway can only be achieved where there are attractive locations for companies to invest. Central to the development strategy for Galway is the designation of the Strategic Economic Corridor (SEC) between Oranmore and Athenry.

The SEC runs east from Oranmore to Athenry and is part of the long standing economic development strategy for the county which has identified priority areas for economic development. The alignment of the corridor is based around that of the Galway to Dublin railway line and the M6 road corridor.

This is a strategically important area which is highly accessible and has easy access and a high concentration of established and valuable infrastructure. This area has the potential to attract significant levels of investment and stimulate economic development and employment creation, performing a number of economic functions to support both the City, County and broader region.

The extent of the SEC has been approximately defined as being 2 kilometres to the north and the south of the Dublin-Galway railway line between the Attymon Train Station and the R381 level crossing at Oranmore. The RSES makes reference to this Oranmore – Athenry Corridor as an example of an opportunity for economic development that should be promoted and to assist in the identification of suitable sites. This SEC should also be serviced to high international standards to attract further FDI and indigenous industries which would further develop the SEC as a strategic location with readily accessible infrastructure.

5.7.2 Atlantic Economic Corridor

Galway County Council will continue to work with regional development authorities and collaborate with other Local Authorities in order to achieve economic development on a regional scale. The Atlantic Economic Corridor (AEC) covers 9 counties and 10 Local Authorities. These include Donegal, Leitrim, Sligo, Roscommon, Mayo, Galway, Clare, Limerick and Kerry.

The AEC concept stems from the need to address regional imbalance in Ireland and provide a viable alternative to the east region for investment and population growth. With this comes the need to build a new regional concept and brand internationally with a unique Quality of Life proposition.

The aim is to build and increase collaboration within the AEC that maximises its assets, attracts investment and creates jobs and prosperity in the region. Partnership operates at every level of the AEC. This involves the collaboration of resources, organisations and networks to deliver common objectives through a wide range of activities and projects. The AEC taskforce comprises Departments and Public Bodies, the Higher Education Sector, Chambers Group & Business Leaders.

The strategic aims of the AEC are as follows:

- Population growth, through retention of talent and inward migration, across the entire AEC – staying in the region to study, work or invest must be an attractive and viable option.

- Local regeneration and rural development will stem from the AEC through regional infrastructural investment and service provision creating viable and thriving communities across the AEC.

- Growth and investment in each of the MASP’s and Growth Centres will create sub-regional impact and consequently local and community level impact.

- AEC will build a strong and progressive collaboration system and network of partners that will create competitive advantage and repetitive success.

Stakeholders

Galway County Council has a significant network of stakeholders via their involvement with the AEC as a regional development driver. These include:

- The Western Development Commission

- Chamber of Commerce

- 10 Local Authorities

- The Northern and Western Regional Assembly

- Department of Rural and Community Development

At present the AEC Hubs project is underway which involves multiple elements such as:

- The creation of a regional network of hubs across the AEC.

- Developing and rolling out a booking engine for all hubs in the region.

- A marketing campaign to promote the hubs and their services.

In addition, the WDC are working in collaboration with AEC Officers on a Talent Tool and the ‘More to Life’ campaign.

5.7.3 (Former Galway Airport Site) Galway Innovation Business and Technology Park

The former Galway Airport site has been identified in the NPF as a Key Growth Enabler. The NPF states that the sustainable development of the former Airport site should provide for employment uses together with supporting facilities and infrastructure. The site is located on the eastern fringes of Galway City and forms part of the metropolitan area as identified in the RSES. The site has an area of 46 HA and includes buildings and a number of potential access points for consideration. This is a brownfield site, the redevelopment of which is supported by both the NPF and the RSES. The vision for the former airport lands is to provide for economic development in this part of the county at a scale which will deliver regional impact. The RSES pledges its support for the delivery of a masterplan for the former airport site which could be prepared on a phased basis where this is deemed appropriate.

The site is located with easy access to the motorway network and has potential connectivity to the existing railway line serving Oranmore. The lands are located in close proximity to the existing large employment areas such as the Parkmore Industrial Estate and the other existing IDA lands at Oranmore and Athenry.

The site is in the sole ownership of Galway City Council and Galway County Council, which provides a degree of autonomy and flexibility in realising the vision for the site as a key employment, research and development site.

A detailed analysis of the former Galway Airport Site has been completed. It examines the potential business and its technological innovation prospects, which includes a vision for the redevelopment of the site that will provide for economic benefit to the wider Galway region. It is considered that the development of these lands represents a unique and paralleled opportunity to deliver sustained economic growth and prosperity.

The purpose of the document is to set out the high level future of the site, including the overall approach and development actions which will give the certainty required to underpin the investment of further time and resources in the further planning and development of the site for employment uses. The overall approach has been discussed with and is supported by both the IDA and Enterprise Ireland.

This vision document is attached to the end of this chapter. It includes a high-level strategy for the development of this brownfield site for a range of uses. It is intended that development will take place within an overall masterplan which will include provision for emerging sectors as well as support industry to all multinational companies. It is also intended to provide space for the future growth potential of the food industry as a follow on from the Bia Innovator Campus development in Athenry.

Overall, this employment site could generate a considerable amount of jobs which would range from 3,676 employees based on light industry employment types to 10,465 employees which would be based on a combination light industry (40%) and commercial (60%) employment types.

5.7.4 Parkmore Industrial Estate

This site is located to the east of Galway City and straddles both administrative areas. This is a well established industrial estate which hosts a number of multinational corporate occupiers, forming part of the med-tech cluster and managed by the IDA. This site is now well served with public transport, a number of key city bus routes serve this location. It has also seen cycle infrastructure upgrades with the addition of a network of cycle lanes. The site is located within the metropolitan area which is discussed further in Volume 2. The remaining section of undeveloped IDA lands now form part of the Briarhill Urban Framework Plan which is include in the Metropolitan Plan in Volume 2.

|

Policy Objectives Spatial Employment Designations in County Galway |

|---|

|

EL 1 Key Employment Locations It is an objective of the plan to continue to deliver and enhance key employment locations and supporting infrastructure within the county. Economic development will be promoted within locations listed in Table 5.4 in order to secure the county’s continued economic development. The objectives for these main employment locations include:

EL 2 Strategic Economic Corridor In relation to the Strategic Economic Corridor the Planning Authority will take steps to:

EL 3 Atlantic Economic Corridor Galway County Council will support regional development through involvement in AEC projects and will continue to develop and enhance the attractiveness of the AEC in County Galway in particular the delivery of improved accessibility and connectivity within the AEC. EL 4 Masterplan for the Former Galway Airport Site Galway County Council and Galway City Council will prepare a masterplan for the Former Galway Airport Site in consultation with all relevant stakeholders including the NTA, TII and Irish Water. The Masterplan will support the development of the lands as an employment campus for innovation, Business Technology, and Aviation. The role of emerging areas such as food and the creative industry as well as green and agri-technology will also be considered as part of this masterplanning process with a view to encouraging the development of clusters of complementary businesses at this location. This will also support the location of businesses that are linked to the multi-national companies, but which cannot be accommodated within the IDA lands. EL 5 Parkmore Industrial Estate Support the continued use of Parkmore Industrial Estate as a major employment site in accordance with proper planning and sustainable development. |

5.8 Sectors, Clusters and Employment Opportunities

The emerging sectors and clusters that are of most importance to the region are:

- Tourism;

- Renewable energy and low carbon future;

- Marine and Blue Economy;

- ICT and Digital Enterprise;

- Life Science (Medtech, Pharma, Biotech, Healthcare);

- Advanced Manufacturing and Engineering;

- Argi-tech and Agri-food;

- Retail.

The economic strategy in this Plan is supportive of each of our priority sectors. Policy objectives to support the tourism economy are set out in Chapter 8 Tourism and Landscape, Chapter 9 Marine and Coastal Management sets out the priorities for the marine sector and support for renewable energy and low carbon future are set out in Chapter 14 Climate Change, Energy and Renewable Resource, A Local Authority Renewable Energy Strategy(LARES) also forms part of this chapter. The Council has recently published a Digital Strategy and the roll out of high-speed broadband across the county continues at pace. This is set out in greater detail in Chapter 7 Infrastructure, Utilities and Environmental Protection.

5.8.1 Life Science

Galway has long been established as an attractive location where a range of industrial clusters in the medical device’s profession have chosen to locate. This sector has made a significant contribution to the county’s local economy over the years. The arrival of Boston Scientific and Medtronic to Galway marked the origins of the med-tech cluster in Galway. The clustering of this industry has taken place in partnership with Galway’s third level institutions and the various industry specialists. This relationship has helped to create a reliable skilled labour pool, and it has led to an international reputation of success and reliability as supported by certain companies in the industry. This cluster effect has led to a growth in supplier firms to serve the market. A number of companies now specialise in cardiology related devices and the various associated components. This has resulted in Galway being recognised as specialising in the development and manufacture of coronary medical devices.

The success of the medical devices cluster is strongly supported by a range of different bodies such as the IDA, Enterprise Ireland, Údarás na Gaeltachta, NUIG and GMIT. Combined these organisations provide a range of supports to the industry which include business development support, finance, access to markets, new customers, access to a skilled workforce as well as knowledge and research facilities. The founding of the National Centre for Medical Devices at NUIG plays an important role in maintaining and promoting Galway as a front runner in the medical devices sector.

Other industries that make a significant contribution to the local economy include biomed and ICT. Similarly, there is a strong link between the larger employers in this field and the nearby educational institutions in Galway.

5.8.2 Foreign Direct Investment

Foreign Direct Investment (FDI) makes a significant contribution to employment creation in Galway. The IDA is the designated state agency responsible for attracting FDI to Ireland. Sources of employment that have been directly created from FDI now include a full range of sectors relating to manufacturing, research, development, innovation, and business services. These industries combined present a significant capital investment and employment base created by FDI companies. The success of ensuring these companies locate in Ireland is hinged on the efforts of a range of public bodies which include local authorities. From a planning perspective, the right environment and conditions will continue to be created in Galway to ensure and support the continued delivery of FDI to the various towns and villages across the County.

There are a number of measures that will ensure the attractiveness of County Galway as a place to locate and do business. This ranges from the delivery of key infrastructure such as the Galway City Ring Road and access to high quality public transport and the creation of high-quality living environment in our main towns and villages.

FDI makes a significant contribution to economic prosperity which in turn is a benefit to the local economy. Other benefits to the provision of FDI include a significant contribution to Ireland’s gross domestic product, employment creation and Government revenue. This was confirmed in 2018 when 70% (€172 billion) of Ireland’s entire exports were generated from FDI companies. In addition, evidence confirms that in 2018 for every ten jobs that created by FDI a further 8 jobs were created in the wider economy, a trend that is essential to Ireland’s employment rates. While the onset of the Covid 19 Pandemic in 2020 has somewhat slowed down economic progress in Galway, it is considered that the established relationship with FDI should continue to prosper into the future to the benefit of the County’s economy. A continued effort to provide the appropriate talent via third level institutions, employment land and a supporting business environment with associated infrastructure will continue to be a priority across the County.

5.8.3 Argi-tech and Agri-food

The agri-food sector is recognised within the RSES as the largest indigenous industry in Ireland. Therefore, it is appropriate to support the industry’s continued development in Galway. Nationally this sector accounts for 8.4% of those in full time employment. The NPF states that the development of this sector into the future will be supported through the implementation of Food Wise 2025. This organisation has responsibility for the development of agri-food as a sector in the Irish economy. Food Wise sets out a series of growth projections pertaining to the development of the agri-food sector and its contribution to the Irish economy. The emergence of this new industry is welcomed in rural Ireland given the various economic challenges that have hindered growth in rural areas across Galway in recent years. Development in rural areas is discussed in greater detail in Chapter 4 Rural Living and Development.

NPO 23 of the NPF sets out its support for a sustainable and economically efficient agricultural and food sector. The sustainable growth of the agri-food sector over the next number of years will need to also adhere to its carbon reduction responsibilities. New advancements in technology and an innovative approach to this sector will assist in this regard.

The Bioeconomy is described in the NPF as comprising the production of renewable biological resources. These include produce such as crops along with forests, fish, animals and microorganisms and the conversion of these resources and waste stream residues, by products or municipal solid waste into value added products. The value-added products that can be produced include food, feed, bio based products and bioenergy. The development of this circular bioeconomy industry where bio products are used for a range of purposes reduce waste levels and enable rural Ireland to contribute to a low carbon, climate resilient society as set out in the NPF. This approach makes use of new technologies and requires a new way of thinking. Given the contribution that the circular and bioeconomy can make to Ireland’s carbon reduction, it is considered that this sector should be supported where appropriate a sentiment that is supported by the NWRA.

5.8.4 Gastronomy

Gastronomy is recognised as an important contributor to our economy and our cultural heritage. It is also linked with tourism development within the county. The Bia Innovator Campus led by Galway County Council and Teagasc is a new departure in food infrastructure in Ireland, which has the benefit of multi-food sector infrastructure and support in one location. These Athenry based supports will include expertise in meat, dairy, consumer foods and seafoods.

The Bia Innovator Campus is best described as a step change project that will transform the food entrepreneurship landscape in the west of Ireland. The campus will address the requirement for a regional food workspace infrastructure by providing a dynamic food and drink innovation and incubation centre of scale. It will be made up of 2,301sqm with the creation of 360 jobs within 3 years in over 40 businesses which will deliver a significant amount of training, development and support from the founding partners and wider stakeholders.

The facility once opened will provide an additional employment source in this part of the county. The facility is being done in partnership with Teagasc who make a significant contribution to the development of agri-rural enterprises in Ireland.

5.8.5 Remote Working

The onset of the Covid 19 pandemic saw an unprecedented acceleration in the number of employees across Ireland working from home. This type of approach to work is not an entirely new phenomenon. It has been a feature in some industries for a number of years. The roll out of high-speed broadband across Galway enables people in certain types of employment to work in locations other than their main place of employment. The option to work from home remote from the place of employment contributes to a reduction in those commuting to work every day. This has the effect of contributing to our carbon reduction. Working from home also gives employees a greater degree of flexibility in managing their work life balance. There are also benefits to the employer pertaining to the level of office space that is required by an organisation which can be a high cost for employers.

The roll out of working from home changes the necessity to live in easy commuting distance of the workplace. In the case of Galway, it may well be the case that people will now chose to relocate here to avail of the high quality of life that rural County Galway has to offer without the need to commute daily to work. Support where possible will be given to those working from home.

The RSES also advocates the delivery of a ‘smarter economy’ across the region through the delivery of high-speed broadband in the more remote parts of the County. The addition of remote working hubs in towns and villages across the county will provide further flexibility to those wishing to “log-on” while travelling across the county. Such a facility in some of the more rural parts of the county could have the effect of attracting a significant number of people into town and village centre locations on working days which could contribute to the local economy. This type of use it is considered would be of great benefit from and enterprise and economic perspective.

|

Policy Objectives Sectors, Clusters and Employment Opportunities |

|---|

|

SCO 1 Continued Investment Support the continued provision of employment investment across County Galway in accordance with proper planning and sustainable development. SCO 2 Foreign Direct Investment The Plan will seek to retain the relationship created with FDI’s in recent years by identifying appropriate sites and conditions for these international companies to locate and develop in Galway. SCO 3 Agri-food Industry and Rural Diversification Support the development of the agri-food industry and rural diversification in a sustainable manner across County Galway facilitating research and development where appropriate. SCO 4 Ag-innovation Clusters Support the development of ag-innovation clusters in County Galway encouraging improved links between farm, research, technology and commercialisation in accordance with proper planning and sustainable development. SCO 5 Gastronomy Sector To protect and support the development of the gastronomy sector as part of our cultural heritage in County Galway as a source of sustainable economic development. SCO 6 Bia Innovator Campus To support and facilitate the development of the Bia Innovator Campus at Athenry as a centre of expertise in the development of food science, industry and technology. SCO 7 New Enterprise Support exploratory research, pioneering projects, new start up businesses/industries and retraining programmes in conjunction with the development agencies and educational/research institutions. SCO 8 Hubs and Remote Working Promote the development of Smart Towns and Villages across County Galway to develop and diversify the rural economy and build on local enterprise and infrastructure assets to drive innovations around smart technologies in energy, transport, agri-food, tourism, e-services and remote working including working hubs. |

5.9 Retail

The RSES seeks to support the role of smaller and medium sized towns, which demonstrate an important role in terms of service provision and employment for their catchments within the economic function of the county. Galway has a range of towns and villages of varying scales with varying levels of economic activity. Such settlements are identified within the settlement hierarchy and the core strategy of this Plan.

On retail strategy development, the RSES highlights the competition between the conventional town centre shopping experience with that of online shopping highlighting the impact this will have on the vitality and viability of our town centres and village main streets. The onset of the Covid 19 pandemic has accelerated the market share of the online sector placing an increased pressure on a greater number of Irish retailers to develop their online presence to compete. This trend has important policy challenges for the development plan in seeking to maintain its traditional retail centres across the settlement hierarchy.

Retail Planning Guidelines, 2012 specify that the development plan must be:

- Evidence-based through supporting analysis and data to guide decision making;

- Consistent with the approach of these guidelines; and

- Clear and concise with regard to specific objectives and requirements.

5.9.1 Retail Hierarchy/Strategy

The NPF contains strategic policies seeking to ensure the vitality and viability of Ireland’s urban and rural places. NPO 6 relates to the role and function of urban places, highlighting the Government’s ambition to regenerate and rejuvenate cities, towns and villages as environmental assets to ensure the resiliency and vitality of urban places. NPO 11 sets out a presumption in favour of development that will encourage people, jobs and activity within existing urban places of all sizes.

The Core Strategy is statutorily required to contain information to show that in setting out objectives for retail development, the Planning Authority has had regard to the Retail Planning Guidelines and that the estimates of required future retail development are based on and take account of the specific population targets. In addressing this requirement, Galway County Council intends to prepare a Retail Strategy in conjunction with Galway City Council. This Retail Strategy shall take account of the above requirements.

The retail hierarchy for the County is set out below and a number of policy objectives regarding retail management are identified. The retail hierarchy aligns with the designation of settlements in the Core Strategy table and associated Settlement Hierarchy, MASP, Key Towns as the main focus for new retail developments. Appropriately scaled new retail development in centrally located sites within the remaining towns and villages shall also be encouraged.

The approach to retail development must align with the provisions of the Settlement Hierarchy, which consists of the following categories:

- Metropolitan County Galway (Baile Chláir, Bearna, Oranmore)

- Key Towns (Ballinasloe, Tuam)

- Location of Strategic Potential (Athenry)

- Small Growth Towns (Clifden, Headford, Maigh Cuilinn, Oughterard, Portumna)

- Small Growth Villages (An Cheathrú Rua, An Spidéal, Ballygar, Dunmore, Glenamaddy, Kinvare,Moylough)

|

Level / Retail Function |

Centre |

|---|---|

|

Level 1 |

Galway City (within Galway City Council’s functional area and core retail area) |

|

Level 2 District Centre |

|

|

Level 3 District / Sub County Towns |

Ballinasloe Tuam Athenry Gort Loughrea |

|

Level 4 Neighbourhood Centre |

Baile Chláir Bearna Oranmore Garraun Briarhill |

Level 5 Small Town/village centre/Rural Area |

Clifden Maigh Cuilinn Oughterard Portumna Headford An Cheathrú Rua An Spidéal Ballygar Dunmore Glenamaddy Kinvara Moylough |

Table 5.5 Retail Hierarchy

|

Policy Objectives Retail |

|---|

|

RET 1 Retail Hierarchy The Planning Authority will actively promote a hierarchy of retail functions in the County that complements the settlement hierarchy of this plan and there will be a general presumption against out of town retail development. RET 2 Retail Strategy Support and promote the retail sector in the County and ensure compliance with the Retail Planning Guidelines for Planning Authorities DoECLG (2012), including the need for a sequential approach to retail development, the policies objectives of any future Retail Strategy for Galway and the guidance set out in the Retail Design Manual DoECLG (April 2012). RET 3 Joint Retail Strategy It is an objective of the Planning Authority to work with Galway City Council to prepare a joint retail strategy as per the requirement under Section 3.5 of the Retail Planning Guidelines for Planning Authorities (2012). A Joint Local Authority Working Group will be set up to prepare and deliver a Joint Retail Strategy for the Galway Metropolitan Area. The Joint Retail Strategy which will identify requirements for further retail will be completed within 1 year of the adoption of both city and county plans and will be adopted by way of variation to this Plan. |

5.10 Core Shopping Areas

The Retail Planning Guidelines place a strong emphasis on the importance of delivering vibrant town and village centres. It is further considered in the RPG’s (2012) that this importance on Town Centre vibrancy can be delivered through strict adherence to the provisions of the ‘sequential approach’, which will safeguard the delivery of vitality and viability in town and village centres. The towns and villages each contain town or village centre zoning designations. These areas provide a mix of convenience shopping and other local services. The scale of retail provision in each town and village varies depending on the size of the town or village, its location and its catchment area as well as its proximity to Galway City.

The towns and villages are an important focal point for rural Galway. Other uses taking place in towns and villages include weekly food markets or the sale of livestock at local marts which attract a considerable number of visitors to an area and create retail diversity. These are interdependent uses which are of benefit to town and village centres. Variety in the services on offer is required in order to achieve and maintain a vibrant town or village centre. A proliferation of one particular use above all others that jeopardise this vibrancy.

5.10.1 Vacancy

The level of vacancy in the town and village centre areas has become a pronounced issue in certain towns and villages in recent years all over Ireland, particularly in more rural structurally weak areas. This has resulted from a variety of factors that pre-date the Covid 19 Pandemic and include not least the advent of online retailing. A concerted effort will be made through various funding mechanisms to ensure that the core shopping areas in the towns and villages of all sizes are attractive, maintained and well serviced with infrastructure to secure their prosperity into the future.

NPO 16 highlights the Government’s intention of addressing vacancy rates in small town and village centres to reduce rural decline and encourage the viability and vibrancy of rural areas. The RSES also places particular emphasis on the challenge presented by vacancy rates in our towns and villages. The national vacancy rate stands at 13.5% and the rate for the county stands at 16.6%[2]. Of the towns and villages in the county both Tuam and to a lesser extent Loughrea have higher vacancy rates of 21.8% and 16.8% respectively. Although the vacancy rate in Loughrea has reduced by 1.4% since the last survey in Q2 2019 the rate in Tuam has increased by 0.5%.

Trends are consistent with trends in the wider province. Of the four provinces, Connacht continued to have the highest vacancy rate at 17.0% in Q2 2020, which equated to a 0.4pp increase versus Q2 2019. The top five counties with the highest vacancy rates were all in Connacht: Sligo (19.3%), Leitrim (17.1%), Galway (16.6%), Roscommon (16.6%) and Mayo (16.6%).

5.10.2 Local Shops and Services

Outside of town and village centres there remains to be demand for local convenience shops, which are often associated with service stations. These facilities offer important day to day goods and services to those in the area. Such facilities are often utilised as part of a multi trip for example during school drop-off and pick-up. These facilities can be located in close proximity to schools, employment lands and residential areas. However, retail in the first instance should be provided in the towns and villages. The floorspace of out of town local shops and services should not exceed 100sqm in accordance with the RPGs (2012). In cases where the floorspace exceeds 100sqm, the sequential approach will apply.

5.10.3 Evening and Late-Night Uses

The Evening/Night-Time Economy has a growing importance in Ireland as evidenced by the establishment of the Night-Time Economy Taskforce in July 2020. Its purpose is to develop new approaches to supporting and developing this industry further. The night- time and evening economy is not a new concept. It includes a variety of activities ranging from pubs, restaurants, cafes, clubs, takeaways, cinema, theatre and other means of entertainment. The Evening/Night-Time Economy can make a significant contribution to the local economy to the benefit of towns and villages across County Galway. Night-time activities in towns and villages should be supported provided it is without detriment to residential amenity and night-time and evening activities should delivery vitality and viability, creating a safe environment for visitors and residents alike.

5.10.4 Petrol Filling Stations

Petrol filling stations have incorporated convenience shopping for many years and in many rural locations, the petrol station is the only retail service in the area. In these instances, it may be appropriate to facilitate the development to provide a wider range of products across a generous floor area. Conversely a significant number of petrol stations and associated shops have been developed on the outskirts of larger towns. Hence in these cases, it may be necessary to limit the range of products on offer and the customer floor area to safeguard the provision of retail within the town centre. Having regard to the aforementioned, the Council will consider proposals on an application by application basis. Furthermore, the Retail Planning Guidelines (2012) state that the floorspace of an associated shop should not exceed 100sqm and that the sequential approach should be applicable to any proposal for floorspace in excess of this threshold.

|

Policy Objective Core Shopping Areas |

|---|

|

CSA 1 Balanced Retail Development Ensure that in the interest of vitality and viability, development proposals result in a balance of services and outlets, thus avoiding an over-concentration of uses. CSA 2 Retail and Complimentary Uses To encourage and support a healthy mix of retail and other appropriate complimentary uses in town and village centres and identify targeted measures to reduce the vacancy rates. CSA 3 Town Centre Uses To support where possible planning applications which propose complementary, non-retail uses in town and village centres, where high vacancy levels are evident. CSA 4 Shop Fronts and Signage Building facades in town and village centres make a significant contribution to the attractiveness of a place. The development of shop fronts and associated signage should be given careful consideration in town and village centres, particularly in Architectural Conservation Areas. CSA 5 Shop Front Design To encourage high quality shop front design in town and village centres particularly in designated ACA’s. CSA 6 Local Centres To support the provision of local centres serving local catchment populations in new residential areas, commensurate with locally generated needs. CSA 7 Local Shops and Services Facilitate the development of small shops and services at peripheral locations within town settlements only where it can be demonstrated that they are of a scale to serve only localised demand and will not impact negatively on the vitality and viability of the existing town centre. CSA 8 Evening and Late-Night Uses To support proposals for development involving off-peak evening and late night, commercial, retail or leisure uses within or immediately adjacent to town and village centres, where it can be demonstrated that the development will enhance the character and function of an area and not detract from the residential and general amenity of the area. CSA 9 Management of Late-Night Uses Seek to uphold environmental quality standards through the application of good practice principles in the management of late-night uses, in the form of stipulating litter prevention measures and regulating hours of operation. CSA 10 Retailing and Associated Petrol Stations Consider development proposals for shop facilities accompanying petrol stations on their individual merits, having regard to the Retail Planning Guidelines for Planning Authorities (2012) and subject to traffic implications. CSA 11 Strategic Town Centre Development Be supportive of existing marts and co-ops in the County which seek to relocate from prime town centre locations to edge of town locations subject to adherence to normal planning requirements and development management standards, thus allowing for the expansion of a town centre/core area for retail and commercial purposes. CSA 12 High Quality Retail Environment Support the development of appropriate types, scales and patterns of retail development in suitable locations within the settlements of the County and with high quality design that:

|

Map 5.1: Economic Engine